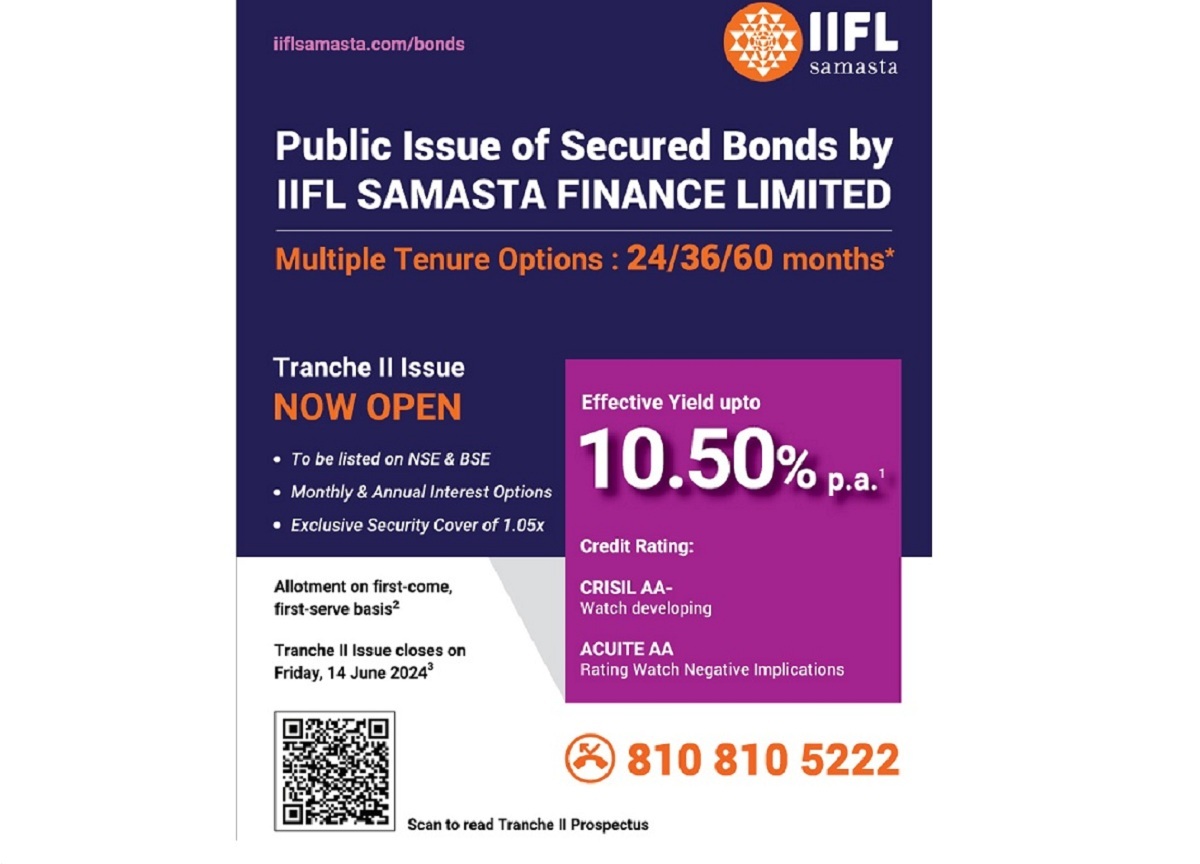

IIFL Samasta Finance Limited announced plans to raise up to Rs 1,000 crores through a public issue of secured bonds. The initiative aims to bolster capital and support business expansion.The bonds, featuring a high coupon rate of up to 10.50% per annum, will be available from June 3 to June 14, 2024. IIFL Samasta will initially issue bonds worth Rs 200 crore, with an option to retain oversubscription up to Rs 800 crore, totaling Rs 1,000 crore. The bonds will be offered in tenors of 24, 36, and 60 months, with interest payments available on both monthly and annual bases.

The bonds carry a “CRISIL AA-/Watch Developing” rating from CRISIL Ratings Limited and an “Acuite AA| Rating Watch Negative Implication” from Acuite Ratings and Research Limited. These ratings reflect a high degree of safety.Venkatesh N, MD and CEO of IIFL Samasta Finance, highlighted the company’s extensive reach through 1,500 branches across India, primarily serving women entrepreneurs from underprivileged backgrounds. “The funds raised will meet the credit demand from our customers and support business growth,” he stated.

IIFL Samasta Finance reported a record net profit of Rs 503.05 crore for the financial year 2023-2024, with loan assets under management rising 34.67% to Rs 14,211.28 crore. The customer base also grew to 30.01 lakh as of March 31, 2024, largely in rural and semi-urban areas.The public issue’s lead managers include Trust Investment Advisors Private Limited, Nuvama Wealth Management Limited, and IIFL Securities Limited. The bonds will be listed on the BSE Limited and National Stock Exchange of India Limited (NSE), providing liquidity for investors.

+ There are no comments

Add yours